The Ultimate Fintech MVP Vendor Checklist: 10 Must-Ask Security & Compliance Questions

Navigating the Fintech MVP Minefield

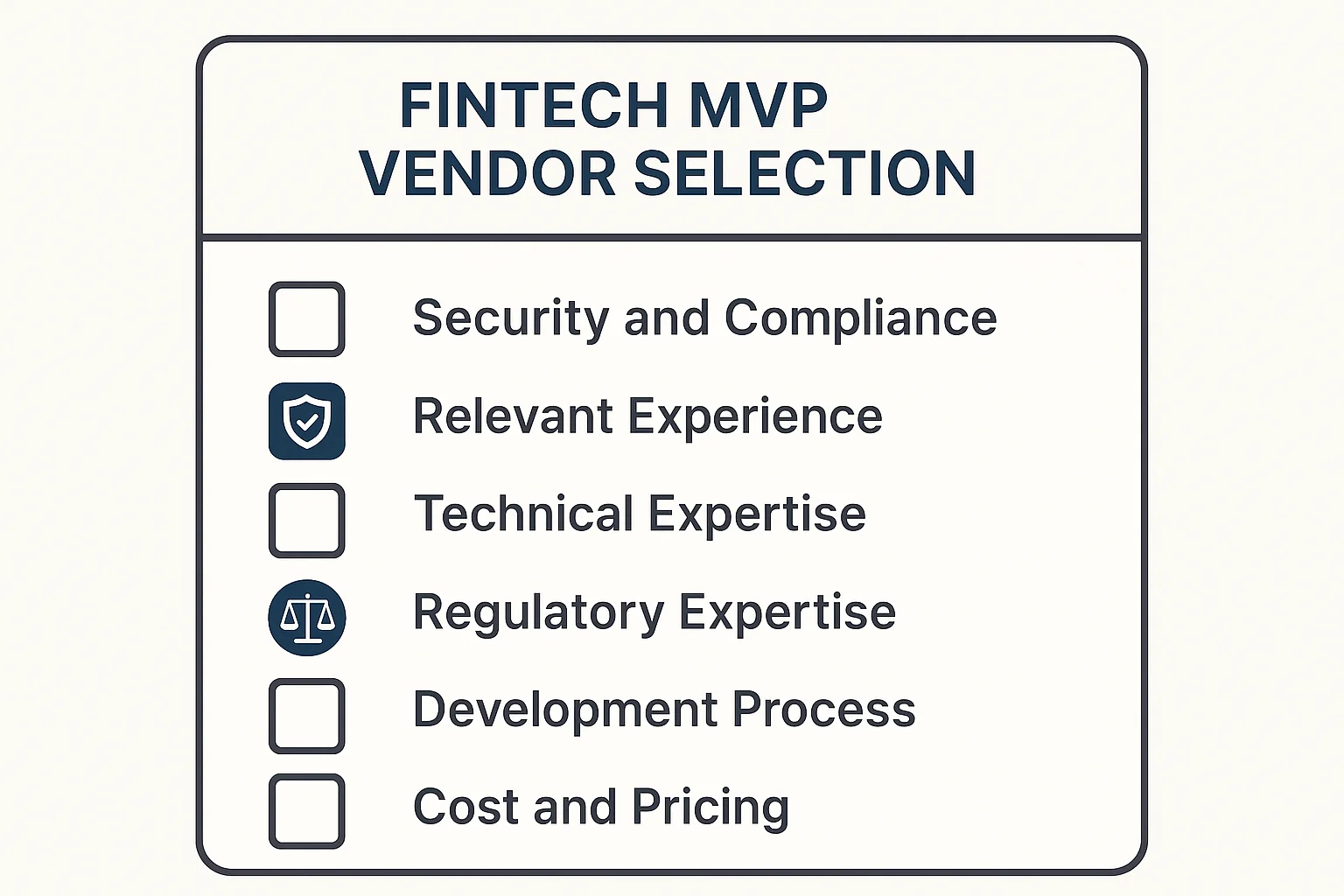

As a fintech founder, your game-changing idea is only as strong as the technology it’s built on. But the single most critical decision you'll make for your MVP isn’t about features—it’s choosing your development partner. In the high-stakes world of financial technology, security and compliance are not post-launch concerns; they are your foundation. A misstep here can lead to crippling rework, regulatory fines, or a fatal loss of user trust before you even get started. For non-technical leaders, vetting a vendor’s security and compliance expertise can feel daunting. To provide guidance on how to Secure Funding Faster: How to Choose the Right MVP Development Agency for, we created this definitive checklist. Think of it as your essential due diligence tool, designed to give you the clarity and confidence to select the right partner. These ten questions will help you cut through sales pitches, de-risk your investment, and ensure your MVP is built securely from day one.

Fintech Expertise & Proven Track Record: Beyond General Development

Building a fintech product isn’t the same as building a standard mobile app; the stakes are infinitely higher. A generalist development agency might build a functional product, but a true fintech partner builds a defensible one. Your first due diligence step is to validate their specific experience in this highly regulated domain. A misstep here can lead to crippling rework, compliance fines, or a complete security failure.

To assess a vendor’s credentials, move beyond their portfolio and ask targeted questions. Use this checklist to uncover their true fintech acumen:

- Analyze Relevant Case Studies: Do their past projects involve payment processing, digital wallets, lending, or investment platforms? Look for evidence that they have successfully navigated complex integrations with financial institutions or third-party APIs like Plaid or Stripe.

- Verify Regulatory & Compliance Knowledge: Ask them to describe how they’ve addressed specific regulations like PCI DSS (for card data), GDPR (for user data), or AML (Anti-Money Laundering) in previous builds. Their answer should be practical and tied to real-world architectural decisions, not just theoretical knowledge.

- Confirm In-House Expertise: Does their core team include specialists with experience in financial data security and encrypted data handling? Or are they outsourcing this critical component?

- Request Fintech-Specific References: Ask to speak directly with other fintech founders they have worked with. This provides an unfiltered view of their ability to handle the unique pressures and security demands of the industry.

Robust Security Posture & Practices: Protecting Your Fintech Foundation

When launching a fintech idea, trust is your cornerstone; a single security breach, particularly during the MVP stage, can be devastating. Beyond their stated expertise, it's vital to verify that a potential development partner not only understands but actively practices robust security in their daily operations. Their internal protocols are a direct reflection of how they will safeguard your sensitive data and protect your future customers. For a deeper dive into selecting an MVP development partner, considering all critical aspects, resources such as How to Choose a HealthTech MVP Development Partner: The Founder's Checklist offer valuable insights, emphasizing a comprehensive vetting process applicable across various industries.

To specifically probe beyond surface-level claims regarding security, and assess a partner’s genuine commitment, utilize the following checklist. A partner who can confidently answer these questions demonstrates a serious approach to your product's integrity:

The Security Practices Checklist:

- Secure Coding Standards: Do your developers follow established security guidelines, like the OWASP Top 10, to prevent common vulnerabilities from day one?

- Data Encryption: Can you confirm all sensitive data will be encrypted both when it’s stored (at rest) and when it’s being transmitted (in transit)?

- Access Control: What policies do you enforce to limit internal access to our project’s code and data (e.g., the principle of least privilege)?

- Security Testing: Do you integrate security testing, such as vulnerability scanning and code reviews, directly into the development lifecycle?

- Incident Response Plan: Can you walk me through your process for identifying, containing, and reporting a security breach if one were to occur?

A vague or hesitant answer to any of these questions is a significant red flag. A truly secure partner will welcome this scrutiny and be prepared to discuss their security framework in detail, providing the confidence that your foundation is solid.

Regulatory Compliance & Certifications: Meeting Industry Standards (PCI DSS, GDPR, AML)

Navigating the alphabet soup of fintech regulations—PCI DSS for payments, GDPR for data privacy, AML for anti-money laundering—can be overwhelming. While your MVP doesn’t need to be fully audited from day one, its architecture must be built with compliance in mind. For founders, understanding and implementing data privacy requirements, such as those outlined in The Founder's Fast-Track Guide to GDPR Compliance for Your MVP, is crucial from the outset. A misstep here can halt your progress and erode user trust before you even launch. Your development partner should be your guide, not just a builder.

Use this checklist to verify their expertise and ensure they are building a compliant-ready foundation for your product:

- Specific Regulatory Experience: Can they provide case studies of products they've built that required adherence to [insert relevant regulation, e.g., PCI DSS Level 1, GDPR]?

- Team Certifications: Do their developers, architects, or security specialists hold relevant certifications (e.g., CISSP, CISM, or specific cloud security certs)?

- Compliance-by-Design Process: How do they integrate compliance and security requirements into the development lifecycle, from initial design to deployment?

- Audit & Assessment Support: Have they previously helped clients prepare for and successfully navigate security audits or penetration tests?

Data Privacy & Confidentiality Safeguards: Building Trust with User Data

Your fintech app's success hinges on users trusting you with their most sensitive information. A data breach, especially early on, isn't just a technical problem—it's an existential threat. Your vendor isn't just writing code; they are a custodian of your users' data. Before signing any agreement, use this checklist to verify their commitment to privacy and confidentiality.

Data Privacy & Confidentiality Checklist:

- Ask for their Data Handling Policy: Do they have a formal, documented process for managing sensitive customer data throughout the development lifecycle?

- Verify Access Controls: Who on their team will have access to your data? How do they enforce strict role-based access to ensure only authorized personnel can view sensitive information?

- Confirm Encryption Standards: Can they confirm that all user data is encrypted both "at rest" (stored on servers) and "in transit" (moving across networks)? This is a non-negotiable standard.

- Discuss Data Usage in Testing: What is their policy on using data in non-production environments? They should be using anonymized or synthetic data for all testing and development to minimize risk.

- Review their Employee Confidentiality Agreements: Ensure their entire team is bound by strict NDAs and confidentiality clauses that specifically protect client data.

Technical Acumen & MVP Development Methodology: From Concept to Code

Translating your fintech vision into secure, functional code is where a vendor's process truly matters. A great partner doesn't just write code; they build a bridge from your business requirements to a robust technical solution. For non-technical founders, understanding their development methodology is critical to de-risking the entire project, especially when considering Outsourced MVP Development for Non-Technical Founders: Launch Your Idea Without. It ensures transparency, predictability, and alignment, preventing costly misunderstandings down the line.

Use this checklist to probe their approach and ensure they have a structured, transparent process for turning your concept into a reality:

- Requirement Translation: How do you translate business needs into technical tasks for developers? Look for a clear process like user story mapping or detailed specification documents.

- Development Cadence: What is your development methodology (e.g., Agile, Scrum)? How long are your sprints, and what can we expect to see at the end of each one?

- Communication & Transparency: Who will be our main point of contact? What tools do you use for project management (e.g., Jira, Trello), and will we have direct access to view progress?

- Quality & Security Gates: Where in your process do you conduct security reviews and code quality checks? Is it an afterthought or integrated from the start?

- Handling Scope Creep: What is your formal process for managing changes to the project scope or requirements once development has begun?

Transparent Communication & Project Management: Your Partner in Progress

In fintech, a vendor’s code is only half the story. Their communication and project management processes are the critical framework that ensures your MVP is built on time, on budget, and to your exact specifications. An opaque or chaotic process is a major red flag, introducing unnecessary risk into a project where security and precision are non-negotiable. You need a partner who values clarity as much as code.

A reliable vendor operates with predictable rhythms and complete transparency, giving you a clear view of progress at all times. This isn't just about comfort; it's about control and collaboration. Before signing any contract, ensure their process provides the certainty you need. Use this checklist to validate their approach to partnership.

Project Transparency Checklist:

- Dedicated Point of Contact: Is there a single, dedicated project manager assigned to our MVP?

- Defined Communication Cadence: What is the schedule for regular check-ins, demos, and stakeholder updates (e.g., weekly sprint reviews)?

- Shared Project Management Tools: Will we have direct access to your project management system (e.g., Jira, Trello, Asana) to track tasks and progress?

- Formal Change Request Process: How are changes in scope or new requirements formally documented, estimated, and approved?

- Regular Access to a Staging Environment: Will we be able to test and review new features on a staging server as soon as they are developed?

A partner with clear, confident answers to these questions demonstrates a mature process built for success. This structure is your best insurance against costly delays and miscommunication.

Scalability & Future-Readiness: Building for Growth, Not Just Launch

Your MVP’s success can be its biggest risk if the underlying technology can't handle growth. A cheap, quick-to-launch platform that requires a complete rebuild after your first thousand users is not an asset; it’s a liability. True viability means building a foundation that can scale. While you don't need to build for millions of users on day one, your vendor's architectural choices are critical. To truly Future-Proof Your Vision: Choosing the Right Tech Stack for a Scalable MVP, a partner focused on future-readiness prevents you from accumulating "technical debt"—a developer's term for shortcuts that will cost you dearly in time and money later.

Before signing, ensure your vendor can confidently answer these questions about their development approach:

Scalability Due Diligence Checklist:

- Architectural Strategy: How will you design the MVP's architecture to support future features and increased transaction volume without a complete rewrite?

- Technology Stack: Why have you chosen this specific tech stack? How does it support scaling, and are there skilled developers readily available to maintain and expand it?

- Infrastructure Plan: What is your approach to cloud infrastructure (e.g., AWS, Azure)? How will you ensure it can automatically scale to handle traffic spikes?

- Database Design: How will the database be structured to maintain performance as user data and transaction history grow exponentially?

Intellectual Property & Code Ownership: Securing Your Assets

Your idea and the code that powers it are your most valuable assets. Ambiguity around who owns the intellectual property (IP) can lead to disastrous legal and financial consequences down the line. For a comprehensive guide on navigating these critical ownership questions after your MVP is built, consider Your MVP is Built. Who Owns the Code? The Founder's Guide to Securing Your IP. As a non-technical founder, getting this right in your vendor agreement is non-negotiable. It’s the legal foundation that ensures you own what you’re paying for.

Before signing any contract, use this checklist to confirm that your IP is protected. This isn’t just a formality; it’s about securing the core of your future business valuation and your freedom to operate independently.

Ownership & Handover Checklist:

- Explicit IP Assignment: Does the contract clearly state that 100% of all intellectual property, including all source code, software, and documentation created for the project, is the sole property of your company upon creation?

- Third-Party Components: Is there a clear list of all third-party and open-source libraries used? The agreement should confirm that their licenses are commercially compatible and do not compromise your ownership.

- Design & Creative Assets: Does ownership transfer include all UI/UX designs, wireframes, graphics, and other creative assets developed during the project?

- Full Code Access: Does the agreement guarantee a complete and final handover of all source code, build scripts, and necessary credentials immediately upon project completion or termination?

- No Code Re-use: Ensure the contract prevents the vendor from reselling or reusing your proprietary source code, business logic, or unique features for other clients.

Support, Maintenance & Exit Strategy: What Happens After Go-Live?

Launching your MVP is a milestone, not the finish line. The excitement of going live can obscure a critical risk: what happens next? A vendor’s responsibility shouldn't end at deployment. A clear plan for post-launch support and a viable exit strategy are non-negotiable for protecting your investment and ensuring long-term operational stability. Just as a strong foundation is vital for your startup's success, explored in resources like The Pre-MVP Founder Agreement: Your Blueprint to Avoid Startup Failure (Template Included), similar foresight is needed for your vendor partnerships.

Before you sign any contract, use this checklist to gain certainty about the future of your partnership and your product:

- Define the Service Level Agreement (SLA): What are the guaranteed response and resolution times for different issue severities (e.g., critical system outage vs. minor UI bug)? How are support requests managed and escalated?

- Confirm Intellectual Property (IP) and Code Ownership: The contract must state unequivocally that you own 100% of the source code. How and when will it be handed over? Insist on full access to the code repository and comprehensive technical documentation from day one.

- Establish a Clear Handover and Exit Process: What is the documented process for knowledge transfer if you bring development in-house or switch vendors? A professional partner facilitates this smoothly, ensuring you are never locked in.

- Clarify Ongoing Security Maintenance: Who is responsible for applying security patches, updating libraries, and monitoring for new vulnerabilities post-launch? This is a critical, ongoing task in fintech that cannot be overlooked.

Contractual Terms & Financial Stability: Mitigating Legal & Business Risks

Beyond the code, the vendor agreement is your most critical tool for mitigating business risk. A handshake isn't enough when your company's future and users' data are on the line. Before signing, use this final due diligence checklist to ensure your legal and financial foundations are secure. This step provides the ultimate clarity and protects your venture from preventable disasters.

- Intellectual Property (IP) Ownership: Does the contract explicitly state that you own 100% of the source code and all related IP upon payment? This is non-negotiable.

- Confidentiality (NDA): Confirm there's a robust Non-Disclosure Agreement protecting your business logic, user data, and trade secrets throughout and after the engagement.

- Data Breach Protocols: What is the vendor's formal response plan for a security breach? The contract must define their responsibilities, notification timelines, and remediation duties.

- Liability & Indemnification: Who is financially responsible if the vendor's work leads to regulatory fines or lawsuits? Ensure the agreement clearly outlines liability clauses that protect your business.

- Financial Stability: Ask for business references and inquire about their operational history. Partnering with a financially unstable vendor could leave your MVP abandoned mid-development.

- Termination Clause: What are the terms for ending the contract if deliverables aren't met? Ensure you have a clear, fair exit path that doesn't penalize your business.

Making Your Informed & Secure Fintech Vendor Decision

Choosing a development partner for your fintech MVP is the most critical decision you'll make. It’s not just about building features; it’s about building a secure, compliant foundation for your entire business. The right partner mitigates risk, accelerates your path to market, and protects your future customers. The wrong one can lead to costly rework, regulatory fines, and irreparable reputational damage.

This checklist isn't just a list of questions—it's your final due diligence framework. Before you sign any contract, conduct a final review to ensure your chosen vendor confidently meets these core requirements. This is your last chance to validate that their technical expertise aligns with your non-negotiable security and compliance needs.

Use this final scorecard to make your decision with clarity and confidence.

Final Vendor Decision Scorecard

| Criteria | Vendor A | Vendor B | Notes |

|---|---|---|---|

| Proven Fintech Experience | ☐ Yes ☐ No | ☐ Yes ☐ No | Relevant sub-industry? |

| Demonstrated Compliance Knowledge (PCI, GDPR, AML) | ☐ Yes ☐ No | ☐ Yes ☐ No | Specific examples provided? |

| Secure Development Lifecycle (SDLC) Explained | ☐ Yes ☐ No | ☐ Yes ☐ No | Code reviews, testing? |

| Data Encryption & Handling Policies Clear | ☐ Yes ☐ No | ☐ Yes ☐ No | At-rest and in-transit? |

| Favorable Contractual Terms (IP, Liability, SLA) | ☐ Yes ☐ No | ☐ Yes ☐ No | Reviewed by legal? |

| Strong Communication & Cultural Fit | ☐ Yes ☐ No | ☐ Yes ☐ No | Transparent about risks? |

By systematically vetting your potential partners against these critical points, you transform a potentially overwhelming choice into a strategic business decision. You are now equipped to select a vendor that will not only build your product but will also act as a true partner in safeguarding your vision.

Call to Action: Download Your Printable Fintech MVP Vendor Checklist

Selecting the right technology partner is a foundational decision that will define your fintech MVP’s trajectory. While speed and cost are important, they must never overshadow the non-negotiable pillars of security and compliance. Getting these wrong early on can lead to catastrophic reputational damage, regulatory penalties, and a complete loss of customer trust. The ten questions in this checklist serve as your essential due diligence framework, moving conversations beyond sales pitches to substantive proof of a vendor’s capabilities.

Use this guide not just to ask questions, but to demand evidence—certifications, policies, and transparent processes. By rigorously vetting potential partners on these critical points, you aren't just choosing a vendor; you are investing in a secure, scalable, and trustworthy foundation for your business's future success. This diligence now is your best defense against failure later.

Stop worrying about security and compliance gaps; partner with MVPExpert to confidently build your fintech MVP right the first time. Book your free project consultation today.

Børge Blikeng

AuthorHelping startups build successful MVPs for over 5 years