TL;DR: Your MVP ROI story in 60 seconds

- Investors don’t need perfect forecasts — they need credible assumptions.

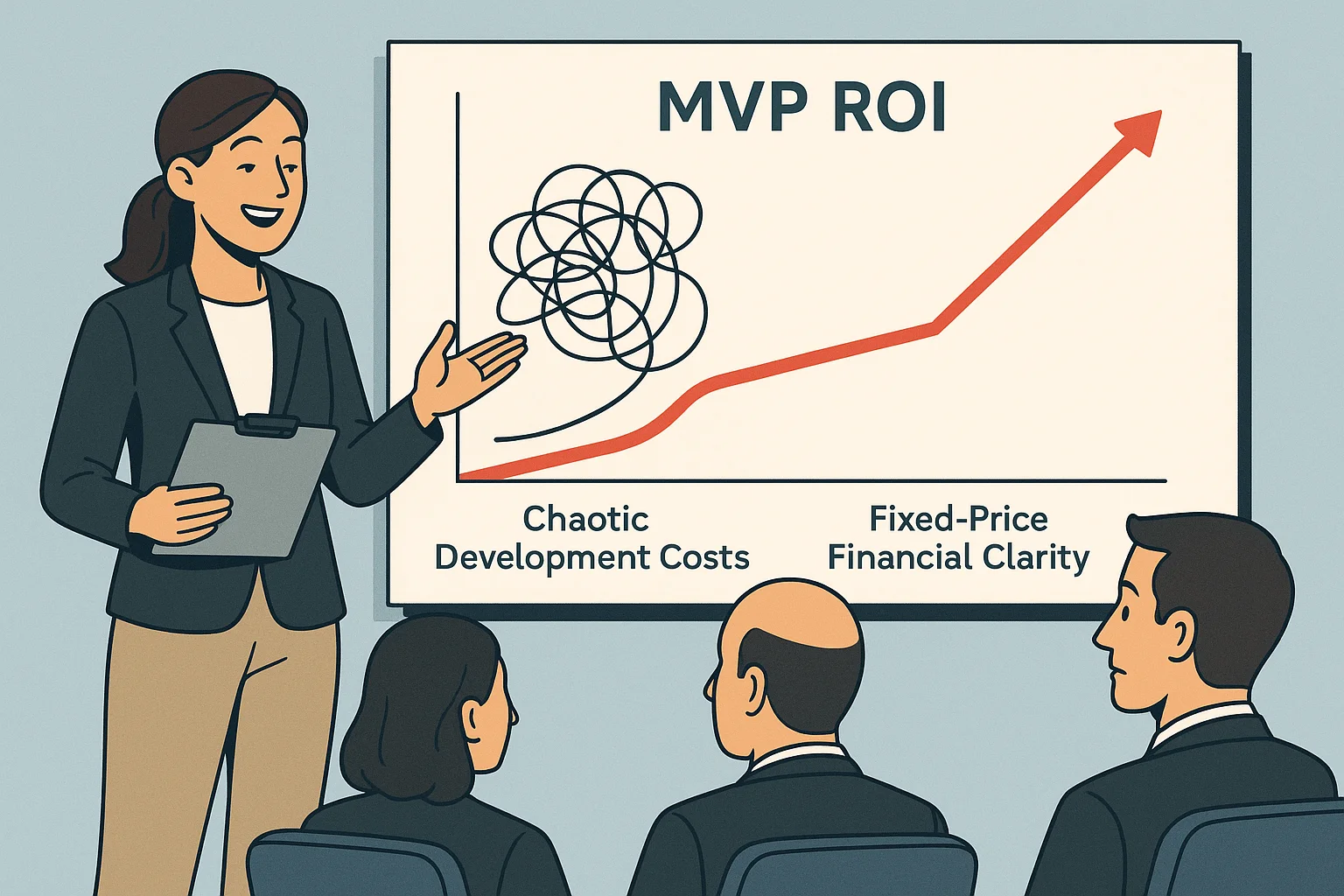

- Your ROI improves dramatically when your biggest cost (build) isn’t a moving target.

- Use bottom-up math: traffic → conversion → revenue → payback period.

The Funding Frontier: Why Unpredictable MVP Costs Are Your Biggest Investor Hurdle

You’ve nailed your pitch deck. Your vision is compelling, your market research is airtight. Then comes the dreaded question from an investor: “What’s the ROI on this?” For most non-technical founders, this is where confidence wavers. How can you project a return when your single biggest cost—development—is a vague estimate at best? This financial guesswork is a funding killer; it introduces risk and undermines your credibility when you can't provide a concrete number. Imagine walking into that meeting with a fixed, known development cost. MVP Cost: Forget Vague Estimates, Here’s the Fixed Price to Launch in 14 Days illustrates how MVPExpert's fixed-price $4,990 MVP makes this your reality. The 'I' in your ROI calculation is no longer a variable; it’s a solid number you can build on. This certainty allows you to calculate a clear, confident, and defensible ROI projection that transforms your pitch from a hopeful guess into a bankable business case.

Understanding the Investor's Mindset: What They Seek in Your MVP ROI

Investors are professional risk managers. When they scrutinize your MVP’s ROI, they aren't just captivated by a big potential return; they are rigorously testing the credibility of your numbers. They know that for early-stage startups, the "I" in ROI—the investment—is often a wild guess, which makes the "R"—the return—feel like a fantasy. To win their confidence, you need to show them a plan grounded in certainty. To truly demonstrate that you can de-risk their capital and secure funding, consider strategies like those outlined in De-Risk Your Startup: How to Secure Investor Funding with a 14-Day MVP. They seek:

- A Defensible Investment Figure: Vague development estimates are a major red flag. When you can present a fixed, predictable cost to build your MVP, you demonstrate financial discipline and immediately make your entire projection more believable.

- Clear Validation Milestones: What specific market assumptions will your MVP prove or disprove? Investors want to see that your initial capital is being used efficiently to answer the most critical questions about customer demand and viability.

- Early Traction Metrics: Your ROI isn't just financial. It's also the return on learning. Show investors how the MVP will generate tangible data—like user sign-ups, engagement rates, or pre-orders—that validates your business model.

- A Plausible Path to Scale: Connect the dots. How will the learnings and traction from this initial, controlled investment create a clear and logical pathway to future growth and profitability?

Ultimately, a strong ROI case isn't about promising the world. It’s about presenting a realistic, data-driven plan built on a foundation of predictable costs.

The Hidden Cost of Ambiguity: Why Variable MVP Development Kills Your Funding Pitch

Imagine walking into a pitch meeting. You've mapped out your market, projected user growth, and forecasted revenue. Then, the investor asks, "What will it cost to build?" If your answer is a vague range—"somewhere between $15,000 and $60,000"—you’ve just lost control of the conversation. This is the classic trap of variable development costs. Agencies that bill by the hour or by "sprints" create a financial black box. They are incentivized by uncertainty, but investors are repelled by it. For them, an unpredictable cost isn't just a budget line item; it's a fundamental flaw in your business model. It signals a lack of control and introduces a massive risk that undermines your entire ROI calculation.

The hidden cost of this ambiguity is your credibility. Presenting a cost spectrum instead of a fixed number makes your financial projections look like guesswork. It forces investors to assume the worst-case scenario, cratering your potential ROI before you even discuss market potential. To build a compelling financial case, you must eliminate the biggest variable. Understanding the precise MVP Development Cost for Startups: The One Fixed Price You Need to Know is crucial. By securing a fixed development cost for your MVP, you transform the most unpredictable part of your plan into its most certain foundation. This allows you to build your ROI forecast on solid ground, presenting a clear, confident, and defensible pitch that investors can actually get behind.

Unlocking Clarity: How Fixed-Price MVP Development Solves the Cost Conundrum

For non-technical founders, estimating MVP development costs can feel like navigating a fog. Traditional agency models based on hourly rates and vague timelines often turn your budget into a moving target. This unpredictability makes calculating a reliable Return on Investment (ROI) nearly impossible, fatally weakening your pitch to investors who demand clear financial projections. How can you confidently forecast a return when your primary cost is a giant question mark?

To truly understand The True Cost of an MVP: How to Eliminate Hidden Fees with a Fixed-Price Model, the answer is to eliminate the variable entirely. A fixed-price development model transforms your cost from a speculative estimate into a concrete certainty. Instead of paying for amorphous blocks of time, you are investing in a specific outcome: a launched product with a pre-defined set of core features. This approach forces disciplined conversations about scope from day one, ensuring you build only what is essential to validate your core business hypothesis. Your development cost becomes a single, predictable line item.

With this number locked in, the "Investment" part of your ROI calculation is solved. Your financial model instantly becomes more stable and defensible. You can now focus your energy on projecting customer acquisition, user traction, and revenue, knowing your initial outlay won't spiral. This clarity empowers you to walk into investor meetings not with a hopeful guess, but with a credible, data-backed plan for profitability, demonstrating fiscal responsibility and a clear path to market validation.

Step 1: Pinpointing Your Precise Investment with a Fixed-Price MVP (Goodbye Guesswork!)

The first step in calculating a believable ROI is to eliminate the biggest variable: the "I" for Investment. For non-technical founders, getting a reliable development cost feels impossible. Traditional agency quotes are often wide-ranging estimates, and freelance hourly rates can spiral, making any financial projection look like pure guesswork to savvy investors. This uncertainty can kill a pitch before you even get to your market potential.

A fixed-price MVP approach fundamentally changes this dynamic, as explored in articles like Predictable MVP Pricing: The One Fixed Price That Truly Matters. By securing a single, all-in cost to build and launch your product's first version, you transform a risky variable into a concrete line item on your budget. This isn't just about financial planning; it's about building a defensible investment case. When you stand in front of investors, your cost is no longer an assumption—it's a locked-in number. This immediately builds credibility and demonstrates your fiscal discipline. It proves you have de-risked the most common point of failure in early-stage tech development: budget overruns.

Choosing this path allows you to confidently:

- Present a clear, precise budget without vague ranges or contingencies.

- Shift investor focus from development risk to your market opportunity.

- Build your financial models on a foundation of certainty, not speculation.

- Calculate an exact break-even point for your initial user acquisition.

Locking in your "I" is the most powerful move you can make to create an ROI calculation that investors will actually trust.

Step 2: Projecting Early Revenue & User Acquisition for Your Investor Deck

Investors understand that early-stage projections are educated guesses. Your goal isn’t to predict the future with perfect accuracy, but to demonstrate a clear, logical, and defensible thought process. A "bottom-up" forecast is the most credible way to do this, as it builds a realistic case based on your direct actions.

Start by mapping out your assumptions for the first 6-12 months post-launch. Avoid vague statements like "we will capture 1% of the market." Instead, detail the specific steps you'll take to acquire your first users and generate revenue. This shows investors you have a tangible plan, not just an ambitious idea.

Use this simple framework to structure your projections for your pitch deck:

| Metric | Your Assumption | Example |

|---|---|---|

| Target Audience Segment | Define your initial beachhead market. | Non-technical startup founders in the US. |

| Primary Acquisition Channel | How will you reach them? | Paid search ads (Google). |

| Monthly Ad Spend | What is your budget? | $2,000 / month |

| Cost-Per-Click (CPC) | What's the industry average? | $10 |

| Website Visitors / Month | Spend / CPC | 200 visitors |

| Visitor-to-User Conversion | What percentage will sign up? (Be conservative) | 5% |

| New Users / Month | Visitors x Conversion Rate | 10 new users |

| Avg. Revenue Per User | Your pricing model. | $100 / month |

| Projected Monthly Revenue | New Users x Avg. Revenue | $1,000 MRR |

This bottom-up model ties your revenue directly to specific marketing activities and costs. When your initial investment cost is a known, fixed number, this clear revenue projection becomes the most critical part of building a powerful and convincing ROI argument.

Step 3: Quantifying Traction: Metrics That Matter to Investors Beyond Just Downloads

Investors see through vanity metrics. While 10,000 downloads might feel like a win, a seasoned investor will immediately ask, "How many of them are still using it?" They’re digging for proof of a sticky product and a viable business model, not just initial curiosity. Your job is to provide data that tells a compelling story about user engagement and future revenue potential, which is essential for Measuring What Matters: The Key Metrics to Track for MVP Success. This is the "Return" side of your ROI calculation, and it needs to be bulletproof.

Instead of focusing on total sign-ups, present investors with metrics that demonstrate true product-market fit and a path to profitability. These are the numbers that form the foundation of a defensible financial projection.

- Weekly/Monthly Active Users (WAU/MAU): This shows how many people find your MVP valuable enough to use it regularly. A high active user count relative to total downloads indicates a "sticky" product.

- User Retention Rate (Cohort Analysis): Track users in weekly groups (cohorts) and measure what percentage are still active after one, two, and four weeks. High retention is one of the strongest signals of long-term value.

- Key Action Conversion Rate: What is the single most important action a user can take in your app (e.g., creating a project, sending a message)? Measure the percentage of users who complete this action. This proves your MVP is solving the core problem you identified.

- Customer Acquisition Cost (CAC) to Lifetime Value (LTV) Ratio: Even early estimates are powerful. Show how much it costs to acquire a user and project their potential value over time. This metric directly speaks the language of ROI.

Step 4: Building a Defensible Financial Model: Connecting Costs to Returns

A financial model isn’t just a spreadsheet; it’s your business narrative told with numbers. For investors, it must answer one question: how does my capital create a return? The credibility of your answer hinges on connecting clear costs to plausible revenue projections.

Most financial models for MVPs fail because the development cost—the "I" in ROI—is a vague estimate. Presenting a range based on hourly rates or agile "sprints" introduces uncertainty, weakening your entire argument. The foundation of a defensible model is locking in your largest initial expense, and understanding The Real Cost to Build an MVP for a Mobile App: A 2024 Breakdown is crucial for this. By starting with a fixed, predictable development cost, you eliminate the biggest variable and build your projections on solid ground.

With your investment cost defined, you can focus on the return side. Build a simple model that connects your MVP investment to key user metrics:

| Metric | Description | Your Projection |

|---|---|---|

| Fixed MVP Cost | The total, one-time investment to launch. | e.g., $X,XXX |

| Customer Acquisition Cost (CAC) | The marketing/sales cost to acquire one user. | e.g., $Y |

| Customer Lifetime Value (LTV) | The total revenue one user will generate. | e.g., $Z |

Your goal is to show investors the path to profitability, demonstrating how many users you need for LTV to exceed CAC plus the initial MVP cost. This clear, simple logic, anchored by a known investment, is what separates a confident pitch from a hopeful guess.

Demonstrating Market Viability: Proving Your Product Has Legs with a Clear ROI

Investors fund businesses, not just ideas. Your Minimum Viable Product (MVP) is the bridge between concept and commerce, providing the tangible proof they need to see a path to profitability. Demonstrating market viability isn’t about having a perfect product; it’s about proving that a real market exists and is willing to pay for your solution. This real-world evidence is what makes the "Return" side of your ROI calculation believable.

When your development cost is a fixed, known number, the entire conversation with investors shifts to the upside—the market proof you've gathered. It removes the biggest risk variable from their perspective. Focus your efforts on gathering this concrete evidence to build an undeniable case. To learn more about thoroughly validating your MVP concept, here's a valuable resource: How to Validate Your MVP Idea Before Development.

Here’s a simple framework for proving your product has legs:

- Secure Pre-Launch Validation: Collect Letters of Intent (LOIs) from potential business clients or run a pre-order campaign for consumers. This demonstrates financial commitment from your target audience before you’ve even launched.

- Track Meaningful Engagement: Go beyond vanity metrics like sign-ups. Measure how early users interact with your MVP’s core feature. Are they completing the key action? Are they coming back? This data proves your solution is sticky and solves a real problem.

- Gather Powerful Testimonials: A handful of glowing reviews from pilot users who have achieved a specific outcome with your MVP is more persuasive than any market size slide.

An MVP built on a predictable budget allows you to focus your energy on gathering this crucial data, turning your pitch from a hopeful projection into a data-backed business case.

Addressing Investor Scrutiny: Common Questions and How Your ROI Answers Them

Securing pre-seed funding demands more than just a brilliant idea; it requires a clear financial roadmap that speaks directly to investor concerns. As explored in depth by resources like The 2025 Edge: How to Secure Pre-Seed Funding with a Standout MVP Prototype, walking into an investor meeting without a solid ROI projection is like navigating a maze blindfolded. Investors use tough questions to test your financial acumen and the viability of your business model. Fortunately, a well-structured MVP ROI calculation provides the answers before they even ask, transforming your pitch from a hopeful idea into a data-backed business case.

Here’s how your ROI directly addresses their biggest concerns:

- Investor Question: "What are your unit economics (CAC & LTV)?"

Your ROI's Answer: Your model inherently defines these. The "Return" is directly linked to your projected Lifetime Value (LTV), while the "Investment" includes your initial Customer Acquisition Cost (CAC). Presenting a clear ROI shows you’ve moved beyond vanity metrics and understand the core levers of profitability for each customer. - Investor Question: "How will this scale profitably?"

Your ROI's Answer: A positive ROI demonstrates a repeatable engine for growth. It proves that each dollar invested generates more than a dollar in return, providing the capital to fuel further expansion. When your initial investment is a fixed, predictable cost, your path to scaling becomes exponentially clearer and more believable. - Investor Question: "What's your validation for this revenue model?"

Your ROI's Answer: Your revenue projections aren’t guesses; they are hypotheses tested by your MVP. By tying your ROI to early user traction and conversion rates, you show your financial model is grounded in real-world market behavior, not just a spreadsheet.

Your Investor-Ready Pitch: Integrating Fixed Costs for Unshakeable Confidence

Investors scrutinize every number in your pitch, but none more so than your projected costs. When you present a wide-ranging estimate for MVP development, you inadvertently introduce risk and uncertainty—two things that kill deals. The conversation shifts from your market opportunity to your budget management, undermining your credibility before you even discuss potential returns.

The most powerful way to counter this is to remove the variable entirely. Embracing Fixed Price MVP Development Packages: Your Predictable Path to Product Launch transforms your biggest unknown into your strongest asset: a concrete, defensible number. This isn't just about budgeting; it's about strategic positioning. It allows you to build your financial model on a foundation of certainty, making your entire ROI projection more believable.

This clarity fundamentally changes your pitch. Instead of a hypothetical range, you can present a clear, data-driven forecast. Your financial slide becomes instantly more compelling:

**MVP Return on Investment (ROI) Projection**

- **Investment (I):**

- MVP Development Cost: $[Fixed, Known Amount]

- Initial Marketing Spend: $[Your Estimate]

- **Total Initial Investment:** $[Your Confident Total]

- **Return (R):**

- Projected Revenue (12 mo.): $[Based on market validation]

- Projected User Acquisition Cost Savings: $[If applicable]

- **Total Projected Return:** $[Your Projected Total]

- **Projected ROI:** ((R - I) / I) * 100 = [A Clear, Defensible %]

With a fixed cost, you walk into your pitch with unshakeable confidence. You can steer the conversation away from budgetary guesswork and focus it on what truly matters: your vision, your market, and the precise return investors can expect.

Fund Your Vision with Confidence: The Power of Predictable MVP ROI

Attempting to calculate a precise financial ROI for an MVP with fluctuating development costs is often a futile exercise. The key takeaway is to reframe the conversation from short-term profit to long-term strategic validation. The true “return” investors seek at this stage is not cash, but invaluable market data, validated user learning, and the systematic de-risking of core business assumptions. This approach demonstrates that their capital is not merely funding code, but purchasing the critical intelligence that paves the path to a scalable, profitable venture.

Therefore, instead of presenting a speculative spreadsheet, your next step is to build a compelling narrative around your MVP’s learning objectives and a clear plan for validation. For instance, a structured approach like The 14-Day Post-Launch Plan: How to Validate Your MVP with Real Users can provide guidance. Focus on the key metrics you will use to measure engagement, validate demand, and prove product-market fit. This powerful “Return on Learning” is the most effective way to justify the investment.

Stop letting unpredictable development costs undermine your investor pitches; secure your funding with a clear ROI using MVPExpert's fixed-price MVP. Book your free project consultation today.

Børge Blikeng

AuthorHelping startups build successful MVPs for over 5 years